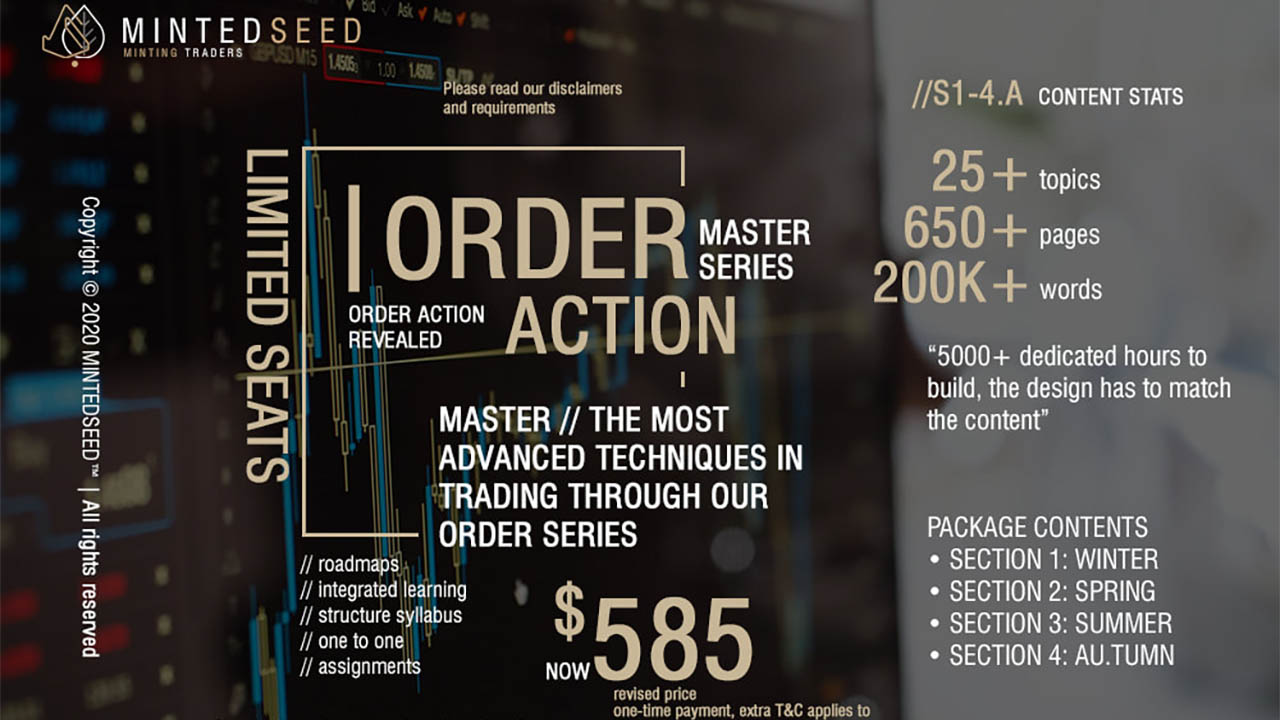

MintedSeed – Order Action

FOREX buying and selling at its most interesting, superseding worth motion. Now we have constructed a self studying course(s) with structured syllabus, designed to be more practical and environment friendly than mentors

The primary ever Order Action course! Making this probably the most and solely complete FOREX buying and selling content material.

With greater than 600+ pages of interactive content material,

4 thoughtfully positioned 4 sections with upcoming content material,

Complimentary movies for designated matters**

If worth motion is the go to technique of studying worth, then order motion is the final word technique of studying the orders inside worth.

It’s a foreign exchange technical evaluation technique design and written by MINTEDSEED with it is core primarily based on orders & liquidity, thus it not solely supersedes worth motion however replaces it altogether. The objective is to create a single customary to outline technical, sentiment, and elementary evaluation into one type of buying and selling. Many have tried to take action however failed, as a result of the one approach to take action is to outline order move in technicals. This in itself makes “your stop-loss, our entry. Your entry, our take revenue”. Lastly, no extra of these imaginary constructions, zones, and so-called worth motion patterns.

Order Action & worth motion variations. The distinction is fairly easy – buying and selling what you see and buying and selling what you do not see. Worth motion is all about buying and selling what you see and studying costs, which is able to finally lead you into manipulation. Order motion is all about studying the hidden orders inside worth – in search of liquidity and studying past the strains of widespread methodologies. Just like worth motion merchants, we don’t use indicators, however, we all know how most merchants are in denial that they’re being manipulated. Indicators and even worth motion is a joke to us. You see, the worth motion you already know about is merely to establish motion and route, however not the sniper entries that we introduce in Part 4. There are merchants on the market that also assume good entries do not exist, sniper entries. By sniper entries, we imply your draw-down is so low that at instances, the unfold is actually the stop-loss. So there’s much less psychology speak about how you bought to tank your positions and inserting belief in trades that you may’t rectify.